- Medicare Cost-Sharing Announced for 2021

- Supreme Court Hears Case Challenging Affordable Care Act

- Infection Control Surveys In Nursing Facilities: As Deaths Soar, CMS Reports Few Deficiencies, Primarily “No Harm”

- Recent Rules and Guidance Address Transparency in Hospice Coverage

- HHS Continues Giving Provider Relief Funds to Nursing Facilities

Medicare Cost-Sharing Announced for 2021

Part A Monthly Premium (For those not automatically enrolled)

- 0-29 qualifying quarters of employment: $471

- 30-39 quarters: $259

Inpatient Hospital

- Deductible, Per Spell of Illness: $1,484

- Co-pay, Days 1 – 60: $0

- Co-pay, Days 61 – 90: $371/day

- Co-pay, Lifetime Reserve Days: $742/day

Skilled Nursing Facility

- Co-pay, Days 1 – 20: $0

- Co-pay, Days 21 – 100: $185.50

Standard Monthly Part B Premium

- $148.50

Part B Deductible

- $203

2021 Parts B and D Income-Related Premiums

| Beneficiaries who file an individual tax return with income: | Beneficiaries who file a joint tax return with income: | Beneficiaries who are married, but file a separate tax return with income: | 2021 Total monthly Part B premium amount | 2021 Part D income-related monthly adjusted amount paid to Medicare (in addition to plan premiums) |

| Less than or equal to $88,000 | Less than or equal to $176,000 | Less than or equal to $88,000 | $148.50 | your plan premium |

| Greater than $88,000 and less than or equal to $111,000 | Greater than $176,000 and less than or equal to $222,000 | $207.90 | $12.30 + your plan premium | |

| Greater than $111,000 and less than or equal to $138,000 | Greater than $222,000 and less than or equal to $276,000 | $297.00 | $31.80 + your plan premium | |

| Greater than $138,000 and less than or equal to $165,000 | Greater than $276,000 and less than or equal to $330,000 | $386.10 | $51.20 + your plan premium | |

| Greater than $165,000 and less than $500,000 | Greater than $330,000 and less than $750,000 | Greater than $88,000 and less than $412,000 | $475.20 | $70.70 + your plan premium |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | Greater than or equal to $412,000 | $504.90 | $77.10 + your plan premium |

– top –

Supreme Court Hears Case Challenging Affordable Care Act

The Supreme Court heard argument on November 10th in the lawsuit seeking a full dismantling of the Affordable Care Act (ACA). The case was brought by Texas and several other states, with the support of the current Administration.

The Center for Medicare Advocacy strongly opposes the meritless lawsuit, and was encouraged by the skepticism shown by several Justices during the argument. In particular, it appears that a majority of Justices may reject the notion that the entire law must be nullified simply because Congress reduced the tax for not purchasing health insurance to $0. Key Justices signaled that if the mandate to have insurance coupled with a $0 penalty is found to be unconstitutional, that one provision may be “severed” and the rest of the ACA can stand. That result is clearly correct under the Court’s own precedent.

A case with such weak legal grounding and dire potential consequences should never have proceeded this far. The plaintiff states and federal government have been irresponsibly arguing that protections for pre-existing conditions, along with all of the ACA’s other critical protections, should be invalidated. This has provoked fear and cast a cloud of uncertainty over the entire U.S. health care system. While the oral argument in front of the Supreme Court was promising, we will not know the final result until a decision issues, likely this spring.

If the Court were to strike down the ACA, it would be devastating for Medicare and the older adults and people with disabilities who rely on it. The ACA is ingrained in Medicare, as it is for the entire U.S. health care system. Losing the ACA would jeopardize critical protections for Medicare beneficiaries, including savings on prescriptions drugs, free life-saving preventive services, and protection from discrimination in health care based on age, disability, race, national origin, and gender. It would also harm the Medicare program by damaging its financial stability, putting the promise of Medicare for future beneficiaries in danger.

The Supreme Court should reject this blatant attempt at ACA repeal via the courts when legislative repeal has failed. The American people have made it clear that the ACA should and must remain the law of the land.

Read the joint amicus brief the Center submitted with AARP and Justice in Aging.

– top –

In March 2020, the Centers for Medicare & Medicaid Services (CMS) suspended the regular survey process and announced that it would conduct limited surveys that focused on infection prevention and control issues.[1] Since June, CMS has made information about these limited surveys publicly available, on the last Wednesday of each month, through the federal website Nursing Home Compare. The Center for Medicare Advocacy has analyzed these survey data each month and issued reports describing the findings. While the total number of surveys has dramatically increased, now totaling more than 40,000, the findings are virtually the same each month.

For six months, CMS has reported that fewer than 3% of the surveys have cited infection control deficiencies, and that the overwhelming majority of deficiencies have been classified as no-harm. A second publicly-available CMS website, Quality, Certification and Oversight Reports (QCOR), reports data about surveys, deficiencies, and civil money penalties. The two publicly-available data sets are not consistent with each other, reporting different information about surveys and deficiencies.[2] Adding to the confusion about surveys and infection control deficiencies is reporting by newspapers and state departments of health about deficiencies and penalties that do not appear on the publicly available federal websites.

Another point of confusion was CMS’s report, on August 14, 2020, that it had cited more than 180 “immediate jeopardy” level deficiencies for infection prevention and control at nursing facilities, triple the rate from 2019, and that it had imposed civil money penalties exceeding $10 million for the deficiencies.[3] CMS acknowledged in a call with nursing home residents’ advocates on August 19 that the data reported on August 14 were available only in an internal CMS database, not on its two publicly-reported databases. Even now, however, nearly three months after CMS’s announcement, the publicly-reported information does not support CMS’s claims about deficiencies or penalties.

Changes in surveys continue. In August, CMS announced that states should gradually begin conducting standard surveys.[4] These survey results are intermingled with the focused infection control surveys.

This report discusses both the sixth cumulative release of focused infection control surveys (reported by CMS on October 28) and, separately, data for the month of September.

Cumulative survey data

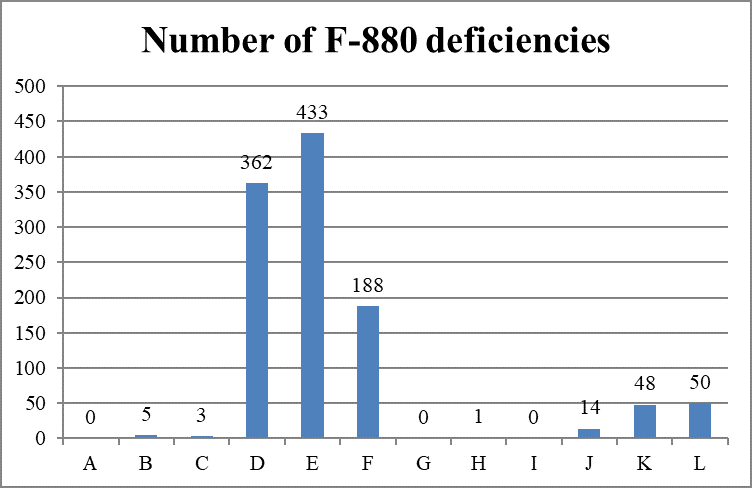

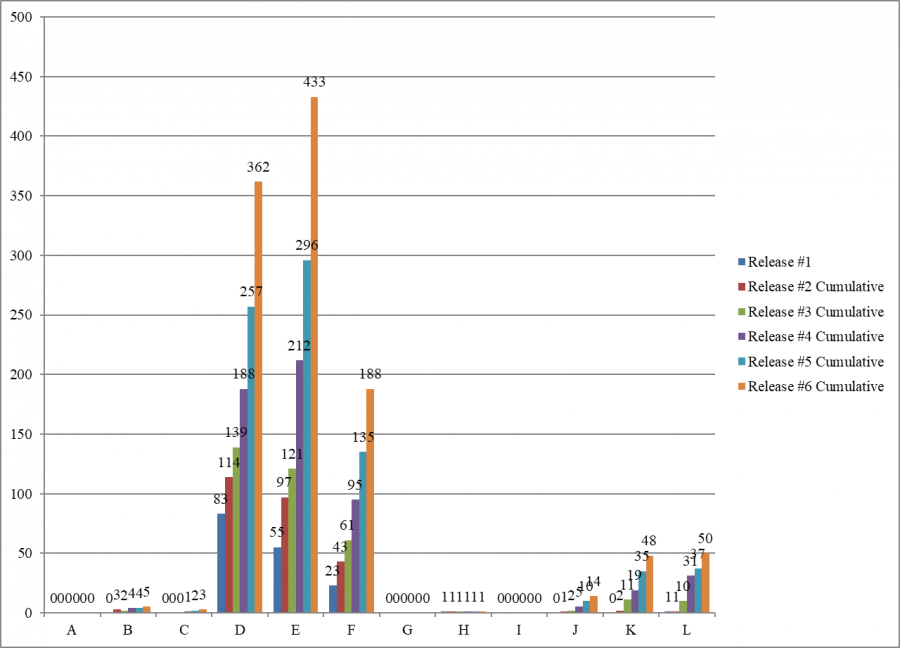

As of October 28, Nursing Home Compare indicates that state survey agencies had conducted 40,144 surveys and cited 1104 deficiencies (2.8%) for infection control (F-880).

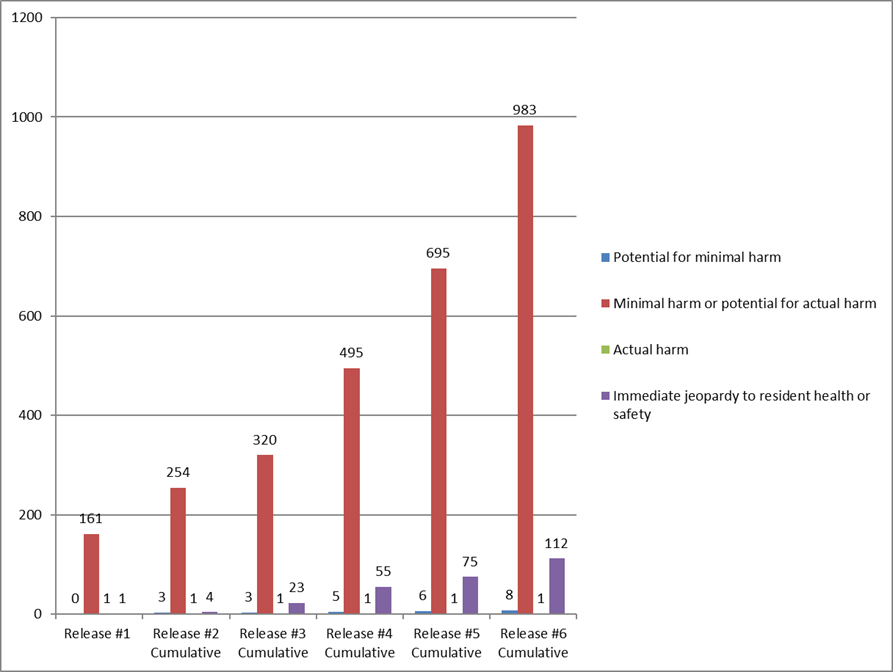

The number and percentage of immediate jeopardy infection control survey have increased with each cumulative survey, but remain a small number and percentage of facilities that have had surveys.

| Date of CMS release | Total number of surveys reported | Total number (percent) of infection control deficiencies cited | Total number (percent) of immediate jeopardy deficiencies cited |

| June 4 | 5,724 | 163 (2.8%) | 1 (1.0%) |

| June 24 | 9,899 | 262 (2.6%) | 4 (1.5%) |

| July 29 | 16,987 | 347 (2.0%) | 22 (6.6%) |

| August 26 | 25,593 | 556 (2.2%) | 48 (8.6%) |

| Sept. 30 | 32,681 | 777 (2.4%) | 75 (9.7%) |

| Oct. 28 | 40,144 | 1,104 (2.8%) | 112 (10.1%) |

Most infection control deficiencies are classified as no harm. Of the 1,104 deficiencies, 983 (89.0%) are classified as “no actual harm with the potential for no more than minimal harm” – i.e., “no harm.” Only 112 of the 1104 F-880 deficiencies (10.1%) are classified as immediate jeopardy.

Each of the six cumulative surveys has cited most of the infection control deficiencies as “no harm” – levels D, E, and F.

Scope and Severity of F-880 Deficiencies

Cumulative Data (Oct. 28, 2020)

As categorized by the combined scope and severity classifications, most deficiencies (983 of 1,104 deficiencies, 89.0%) are cited as “minimal harm or potential for actual harm” (levels D, E, and F), also known as “no harm.”

September Surveys

In September, state survey agencies conducted 3855 surveys. Only 27 surveys (.007%) cited an infection control deficiency. All 27 infection control deficiencies were classified as “no harm.”

Conclusion

As COVID-19 cases increase in nursing facilities nationwide and residents and staff die, CMS continues to report that surveys cite few deficiencies and classify most of them as “no-harm,” meaning no enforcement.

___________________

[1] CMS, “Suspension of Survey Activities,” QSO-20-12-All (Mar. 4, 2020), https://www.cms.gov/files/document/qso-20-12-all.pdf; CMS, ‘Prioritization of Survey Activities,” QSO-20-20-All (Mar. 23, 2020), https://www.cms.gov/files/document/qso-20-20-all.pdf.

[2] “Infection Control Surveys At Nursing Facilities” (CMA Alert, Oct. 29, 2020), https://medicareadvocacy.org/infection-control-surveys-at-nursing-facilities/.

[3] CMS, “Trump Administration Has Issued More Than $15 Million in Fines to Nursing Homes During COVID-19 Pandemic” (Press Release, Aug. 14, 2020), https://www.cms.gov/newsroom/press-releases/trump-administration-has-issued-more-15-million-fines-nursing-homes-during-covid-19-pandemic.

[4] CMS, “Enforcement Cases Held during the Prioritization Period and Revised Survey Prioritization,” QSO-20-35-ALL (Aug. 17, 2020), https://www.cms.gov/files/document/qso-20-35-all.pdf.

– top –

Recent Rules and Guidance Address Transparency in Hospice Coverage

Effective for hospice elections beginning on or after October 1, 2020, Medicare beneficiaries are entitled to greater transparency about the conditions, items, services, and drugs that a provider does not believe are covered under the hospice benefit and will not provide.

In its FY 2020 Hospice Wage Index and Payment Rate Update final rule (84 FR 38520), the Medicare federal agency addressed coverage vulnerabilities in the hospice benefit by requiring (1) additional information on hospice election statements, and (2) provision of a hospice election statement addendum upon the beneficiary’s (or representative’s) request. The agency recently issued guidance concerning these changes. https://www.cms.gov/files/document/mm12015.pdf

In addition to the existing content requirements at 42 CFR § 418.24(b), hospice election statements must now include:

- Information about beneficiary cost-sharing for hospice services;

- A statement indicating that services unrelated to the terminal illness and related conditions are “exceptional and unusual and hospice should be providing virtually all care needed by the individual who has elected hospice”;

- Notification of the individual’s (or representative’s) right to receive an election statement addendum that lists and explains the conditions, items, services, and drugs that the hospice has determined to be unrelated to the individual’s terminal illness and related conditions and will not be covered by the hospice; and

- Information that immediate advocacy is available through the Beneficiary and Family Centered Care Quality Improvement Organization (BFCC-QIO) if the beneficiary (or representative) disagrees with the hospice’s determination.

Upon request by the individual (or representative), the individual’s non-hospice provider, or a Medicare contractor, hospice providers are required to furnish an addendum to the election statement, titled “Patient Notification of Hospice Non-Covered Items, Services, and Drugs.” The addendum must contain a written clinical explanation, in language the individual (or representative) can understand, as to why the identified conditions, items, services, and drugs are considered unrelated to the individual’s terminal illness and related conditions and not needed for pain or symptom management.

The clinical explanation must be accompanied by a general statement that such determination is made for each patient and that the individual should share this clinical explanation with other health care providers from which they seek items, services, or drugs unrelated to their terminal illness and related conditions. The addendum must also reference any relevant clinical practice, policy, or coverage guidelines. Further, it must notify that immediate advocacy is available through the Medicare Beneficiary and Family Centered Care-Quality Improvement Organization (BFCC-QIO) if the individual (or representative) disagrees with the hospice’s determination.

Evidence of a signed addendum in the requesting beneficiary’s medical record would be a condition for payment of the hospice provider’s claim. CMS has importantly clarified that a signed addendum is “only acknowledgement of receipt of the addendum (or its updates) and not necessarily the individual’s (or representative’s) agreement with the hospice’s determinations.” For more details about the new requirements, including timeframes for furnishing the addendum, refer to 42 C.F.R. § 418.24, the Medicare Benefits Policy Manual (Pub. 100-02) Chapter 9, or the agency’s recent guidance. https://www.cms.gov/files/document/mm12015.pdf

– top –

HHS Continues Giving Provider Relief Funds to Nursing Facilities

After giving billions of dollars to nursing facilities from the Provider Relief Fund (PRF) “without strings,”[1] and allowing facilities to spend the funds “without limitations,”[2] the Department of Health and Human Services (HHS) has now announced the first round of “performance payments” to nursing facilities under PRF: $333 million to 10,631 nursing facilities, representing more than 77% of the 13,795 eligible facilities.[3] HHS describes the performance payments as recognizing facilities “for demonstrating significant reductions in COVID-19 related infections and deaths between August and September.” HHS defines “significant reductions” as “keeping new COVID-19 infection and mortality rates among residents lower than the communities they serve, as analyzed against CDC data.”

These criteria both support the nursing home industry’s ongoing pass-the-blame argument that geography, not facility practices, determines the presence of COVID-19 in nursing facilities and undermine the argument (if facilities can take actions to reduce the spread of COVID-19, then geography is not destiny!).

HHS reports that the facilities receiving performance payments had “5,000 fewer COVID-19 infections in nursing homes in September than in August” and that 10,501 facilities (76%) had 1,200 fewer COVID-19 related deaths in September than in August. HHS identifies payments by state (identifying, by state, the total number of facilities and the total dollar payout).[4] HHS does not identify which facilities are receiving performance payments.

The Center asks:

- Which nursing facilities will actually receive “performance payments” and how much money will each one receive?

- How many COVID cases were identified in each facility in August and in September?

- How many COVID deaths were identified in each facility in August and in September?

- Did any of the facilities getting performance payments receive an infection control deficiency in August or September?

- Has any of these facilities with an infection control deficiency in August or September had a civil money penalty imposed for the deficiency?

- How do the performance payments compare with the civil money penalties? Which are higher?

- Is HHS rewarding facilities’ “performance” at the same time that the Centers for Medicare & Medicaid Services is citing these facilities with deficiencies for infection control and imposing civil money penalties?

___________________

[1] In April 2020, CMS Administrator Seema Verma announced the initial payout of $1.5 billion to all skilled nursing facilities receiving Medicare (nearly all the facilities in the country) and said, “‘There are no strings attached, so the health care providers that are receiving these dollars can essentially spend that in any way that they see fit.’” Alex Spanko, “Skilled Nursing Facilities Could Soon See $1.5B Under CMS’s Emergency Relief Plan, With More on the Way,” Skilled Nursing News (Apr. 8, 2020), https://skillednursingnews.com/2020/04/skilled-nursing-facilities-could-soon-see-1-5b-under-cmss-emergency-relief-plan-with-more-on-the-way/, links to the White House press conference where Verma made this “no strings” announcement.

[2] CMS, “Reporting Requirements Policy Update” (Oct. 22, 2020), https://www.hhs.gov/sites/default/files/reporting-requirements-policy-update.pdf. See “Provider Relief Funds: Care for Patients or Boosting Provider Revenues?” (CMA Alert, Oct. 29, 2020), https://medicareadvocacy.org/provider-relief-funds-care-for-patients-or-boosting-provider-revenues/.

[3] HHS, “Trump Administration Distributes Incentive Payments to Nursing Homes Curbing COVID-19 Deaths and Infections” (Press Release, Oct. 28, 2020), https://www.hhs.gov/about/news/2020/10/28/trump-administration-distributes-incentive-payments-to-nursing-homes-curbing-covid-19-deaths-and-infections.html.

[4] https://www.hhs.gov/about/news/2020/10/28/trump-administration-distributes-incentive-payments-to-nursing-homes-curbing-covid-19-deaths-and-infections.html.