- Reflections on the 7th Annual National Voices of Medicare Summit and Senator Jay Rockefeller Lecture

- COVID-19 Updates to Medicare Enrollment and Emerging Social Security Office Efficiencies to Process Changes for Beneficiaries

- CMA Special Report – Infection Control Surveys at Nursing Facilities: It Looks Like Business as Usual

- Center Joins Coalition Urging Officials to Drop ACA-Repeal Lawsuit

- Reminder from CMS – May is Mental Health Awareness Month

- Free Webinar: COVID-19 – Advocating for Nursing Home Residents

- Free Webinar: Medicare Appeals

Reflections on the 7th Annual National Voices of Medicare Summit and Senator Jay Rockefeller Lecture

On April 30, 2020, the Center for Medicare Advocacy held its seventh annual National Voices of Medicare Summit and Senator Jay Rockefeller Lecture. Due to the ongoing COVID health crisis, the Center adapted the in-person program to a “virtual” Summit and Rockefeller Lecture, and rearranged with presenters, sponsors, and participants. Center for Medicare Advocacy Executive Director Judy Stein, and Georgetown University Professor and President of the Center for Medicare Advocacy’s Board of Directors, Judy Feder opened the Summit and framed the discussion of the day around the theme of Medicare’s Promise and Challenges, particularly in light of the ongoing pandemic. Expressing appreciation for speakers, presenters, awardees, sponsors and registrants who made the virtual Summit possible, Ms. Stein emphasized the importance of health care during the pandemic, and the renewed call to join together as a community to strive for health care access for all. “The COVID crisis shines a bright light on the importance of quality health coverage and care,” she said.

Medicare’s Promise and Challenges – From Inception, Expansion, Privatization, and Beyond

Cathy Hurwit, former Chief of Staff to Representative Jan Schakowsky (D-IL), moderated the panel entitled Medicare’s Promise and Challenges – From Inception, Expansion, Privatization, and Beyond. As we approach the 55th Anniversary of Medicare, Tricia Neuman, Kaiser Family Foundation (KFF) Vice President for Medicare, and Judy Stein provided Medicare’s historical background and analyzed the program’s achievements, gaps, and predicted future developments and challenges. Ms. Hurwit set the tone of the panel discussion by reminding the group that prior to the lifesaving “blessing” of Medicare, only about half of seniors had health insurance.

Ms. Stein explained how the social insurance model of Medicare, with uniform benefits, shared risk and shared interest, meant that there was increased health and economic security for all older adults and their families. She emphasized the core considerations for any Medicare changes or expansion efforts. These include fair, adequate, and available coverage that is affordable for beneficiaries, and sustainable for the Medicare program.

Ms. Neuman grounded the group in statistics of average Medicare beneficiaries; providing vitally important information that must be considered when making policy changes to the program. For 2019, half of all Medicare beneficiaries lived on incomes under $29,650 per person; one in four lived on incomes under $17,000. Half of all Medicare beneficiaries had savings below $73,800 per person; one in ten had no savings or were in debt.

Ms. Neuman also reviewed trends related to the growth of enrollment in private Medicare Advantage plans and discussed KFF focus group results about the manner in which beneficiaries make choices when selecting a plan. She explained that the vast number of options become overwhelming; this coupled with limited guidance, leads many beneficiaries to remain in plans that do not serve their needs. “While the marketplace is established on the notion that people will compare plans and choose each year – that is just not happening… people stick with what they have because it is too difficult to make a move….I don’t think it is exactly what policymakers envisioned when they envisioned such a robust marketplace.” Neuman cited that this is a particular problem for individuals with health care issues, especially cognitive issues.

Judy Stein Recognized by National Elder Law Foundation:

Judy Stein Recognized by National Elder Law Foundation:

Amos Goodall presented the Award of Excellence in Elder Law from the National Elder Law Foundation to Judy Stein. Ms. Stein shared heartfelt appreciation to the Foundation, and said that the Foundation is a professional community “in which she found a home, and friends and colleagues and a deep commitment to advancing this world towards the common good.”

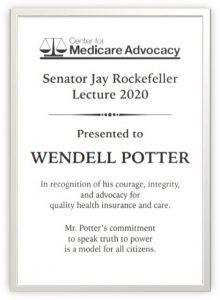

Wendell Potter Honored as the 2020 Senator Jay Rockefeller Lecturer

With welcoming remarks by Judy Feder and Sen. Jay Rockefeller, Wendell Potter was recognized as the 2020 Sen. Jay Rockefeller Lecturer. After nearly 15 years at Cigna Corporation, including leading the company’s corporate communications team and serving as chief corporate spokesperson, Potter left his corporate career to advocate for meaningful health care reform. He made headlines in 2009 when he disclosed in Congressional testimony how insurance companies, as part of their efforts to boost profits, have contributed to spiraling health care costs and the growing number of Americans without health insurance. He also revealed how insurance companies use their customers’ premiums to wage multi-million dollar PR and lobbying campaigns to influence public opinion and public policy.

Judy Feder introduced Sen. Rockefeller and highlighted that the COVID crisis demonstrates the importance of public and political leadership. Calling Rockefeller “someone who reminds us of what the presence of leadership can mean,” she cited his empathy for his constituents and initiative in pursuing the best in public policy for those he represented.

Judy Feder introduced Sen. Rockefeller and highlighted that the COVID crisis demonstrates the importance of public and political leadership. Calling Rockefeller “someone who reminds us of what the presence of leadership can mean,” she cited his empathy for his constituents and initiative in pursuing the best in public policy for those he represented.

Sen. Rockefeller then introduced Mr. Potter saying that he “left the [health insurance] industry because he was confounded by its tone-deafness to the needs of the American people.” Sen. Rockefeller lauded Mr. Potter’s description of the term “choice” used by private insurance companies as a ploy used to entice people to believe that insurance companies provide a freedom that public programs did not.

Mr. Potter opened his remarks by saying that he needs to “make amends for what he used to do for a living” referencing his work for insurance companies. He shared heart-wrenching stories about individuals who were denied life-saving care solely because of an insurance company stepping in between a patient in need, and a doctor and hospital set to provide the needed care. He stressed that more must be done to get people covered and to get providers of all types to stop “putting profits over patients.”

Mr. Potter emphasized in his remarks that Medicare was a “lifesaver for untold millions of Americans” and must be “protected, improved and expanded to cover every last one of us.”

Media – Coverage and Concerns

Center for Medicare Advocacy Associate Director and Senior Policy Attorney, David Lipschutz moderated a panel entitled Media – Coverage and Concerns, with three health reporters: Trudy Lieberman, Mark Miller, and Susan Jaffe. The reporters discussed the challenges inherent in covering Medicare, as the issues are often technically complex and also politically charged.

Ms. Lieberman shared her experience with covering Medicare for decades, and how the narrative has evolved over the years, with turning points during the creation of the Part D prescription drug benefit and during the Affordable Care Act period.

Ms. Lieberman also relayed that many journalists often shy away from writing about Medicare because of the complexity. Mr. Miller agreed with this assessment, saying that Medicare and Social Security have a “long learning curve,” that requires journalists to “relentlessly fact-check” due to this complexity. He further explained that the changing landscape of media and journalism also impacts Medicare coverage. With declining newsroom staffing limiting the ability for journalists to fully immerse themselves in a beat and cover a topic in great detail, mastering the complexities of the Medicare program can be challenging.

Ms. Jaffe also raised the issue that Medicare topics are infused with politics, and have lengthy, complex rules, and that Medicare announcements happen at inconvenient times, making it difficult to get in touch with independent sources. “It’s a lot of responsibility to put on reporters,” she said, and concluded “Reporters need all the help they can get… Feel free to contact [them].”

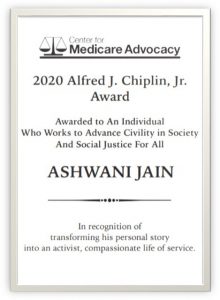

Alfred J. Chiplin, Jr., Social Justice & Advocacy Award

For decades, Alfred J. Chiplin, Jr. (Chip) was a beloved and admired leader in the elder law, disability and health care rights communities. To honor Chip’s long-term advocacy and commitment to civility and justice for all members of society, the Center for Medicare Advocacy established an award in his honor in 2017. The Alfred J. Chiplin, Jr., Social Justice & Advocacy Award, is given annually to an individual who works to advance civility in society and social justice for all – as Chip did for decades.

For decades, Alfred J. Chiplin, Jr. (Chip) was a beloved and admired leader in the elder law, disability and health care rights communities. To honor Chip’s long-term advocacy and commitment to civility and justice for all members of society, the Center for Medicare Advocacy established an award in his honor in 2017. The Alfred J. Chiplin, Jr., Social Justice & Advocacy Award, is given annually to an individual who works to advance civility in society and social justice for all – as Chip did for decades.

The Center for Medicare Advocacy was honored to name Ashwani Jain as the 2020 Chiplin awardee. Mr. Jain, Program Director at the National Kidney Foundation, is a 17-year survivor of childhood cancer. He transformed his personal story into an activist, compassionate life of service. At the National Kidney Foundation he helps area residents get access to primary care services and free preventative health screenings. He is also an Ambassador for the Make-A-Wish Foundation, a YMCA Youth Mentor, and former Presidential Appointee in the Obama White House. The award will be physically presented to Mr. Jain at the Summit in 2021. We look forward to hearing Mr. Jain speak about his experiences when he accepts the award, and we hope that the beloved Chiplin family will be present as they have been in previous years.

Judy Stein closed the Summit with appreciation for the awardees, panelists, attendees, and sponsors who made the event possible – Lecture Sponsor the John A Hartford Foundation, and panel sponsors AARP, Alzheimer’s Association Alzheimer’s Impact Movement, Powers Pyle Sutter and Verville, PC, Santa Fe Group, and SEIU. Ms. Stein concluded with a hopeful promise for an in person 8th Annual Summit in 2021. In the meantime, registrants for the Summit can also attend the Center’s follow up webinar that was included with their registration. The webinar, Medicare Matters in Challenging Times, will be presented on May 20 at 2pm EDT.

Thank you to everyone who joined us for the 2020 Virtual Summit. Stay well!

– top

- Social Security – Availability and Advice for Contacting Offices

National Public Radio recently reported that the backlog of cases pending in Social Security Administration (SSA) offices has fallen by 11% since March 23, when the agency instituted wide-scale telework, and that calls from Social Security recipients are being answered more quickly.[1]

While SSA offices are closed to the public, the Center for Medicare Advocacy (Center) has found the local/regional field offices to be more responsive than usual by telephone. We have been told by SSA offices that since walk-in appointments are cancelled, the staff has more time to respond by phone, if not immediately, usually in the same day. This is true even for issues that have required multiple follow-ups, with multiple people on the line (SSA claimant or Medicare beneficiary in one place, advocate in another, family member in another) – SSA has arranged for those multiple-way calls.

An individual can locate the local SSA office by zip code https://www.ssa.gov/locator/. Then find the phone number for the local office. Callers should leave a message if they get a recording and the call will be returned. Some SSA offices are only responding to messages so they can screen which staff member should return the call.

Still, persistence is likely needed since more people are/will be looking for assistance getting on Social Security and Medicare. As for applications, we recommend that individuals do as much online as possible, then if there are questions, SSA can retrieve the online application attempt by the individual and walk through the areas of the application where people have questions.

- COVID-19-Related Updates to Medicare Parts A and B Enrollment[2]

CMS is granting equitable relief in the form of additional time to use an Initial Enrollment Period (IEP), General Enrollment Period (GEP), or a Special Enrollment Period (SEP) (such as the SEP for when a beneficiary’s enrollment in employer coverage based on current employment ends) in order to file an application for Part B, premium-Part A, or to refuse automatic Part B.

In addition, eligible beneficiaries would not be subject to a late enrollment penalty for the period between the original enrollment period and the enrollment during this extension of the enrollment period. Beneficiaries are eligible for equitable relief due to the COVID-19 pandemic-related national emergency if they were unable to make their Part A or Part B enrollment choice in a timely manner due to delays and problems with access to the SSA to file an application or enrollment election, as a result of the unexpected closure of field offices due to COVID-19.

- The beneficiary had an enrollment period during the period from March 17, 2020, through June 17, 2020, that was an IEP, GEP, SEP; and

- The beneficiary did not apply for Part B (or premium-Part A) or refuse Part B during that IEP, GEP, or SEP.

Individuals who already have Medicare Part A and wish to sign up for Medicare Part B cannot sign up online. Individuals interested in using the relief to enroll in Medicare Part B coverage who are eligible to apply under the IEP or GEP should complete form CMS-40B and mail the request to their local SSA field office.

Individuals who are receiving Social Security benefits before their 65th birthday are considered to be in their IEP and are automatically enrolled in Part A and Part B. Those who do not want to be automatically enrolled in Part B must refuse the coverage within 60 days of receiving their IEP package. Instructions on how to refuse the coverage are included in the IEP package. Individuals may also contact the Social Security Administration at 1‑800-772-1213 (TTY users should call 1-800-325-0778) for more information on how to refuse the coverage.

Individuals interested in enrolling in Medicare Part B coverage who are eligible to apply under the SEP, should complete forms CMS-40B and CMS-L564 (PDF); both forms are available in English and Spanish versions. The CMS-40B application is completed entirely by the individual enrolling in Part B.

For the CMS-L564 enrollment form:

- Section A:

- Must be completed by individuals enrolling in Part B

- Section B:

- Can be completed by the employer; OR

- If it isn’t feasible for your employer to complete the form, leave Section B (the rest of the form) blank and provide at least one of the items listed below. Acceptable proof of employment, Group Health Coverage Plan (GHP), or Large Group Health Plan (LGHP) include but are not limited to:

- income tax returns that show health insurance premiums paid;

- W-2s reflecting pre-tax medical contributions;

- pay stubs that reflect health insurance premium deductions;

- health insurance cards with a policy effective date;

- explanations of benefits paid by the GHP or LGHP; and

- statements or receipt that reflect payment of health insurance premiums

Individuals can fax their completed enrollment forms to SSA toll-free at 1-833-914-2016, or mail the request to their local SSA field office. Although SSA offices are closed for in-person service, requests received by mail are still being processed. Individuals can find the address and phone number for their local field office using the Social Security Office Locator https://secure.ssa.gov/ICON/main.jsp.

This assistance is available retroactive to March 17, 2020, and will continue for a period of 3 months ending June 17, 2020. Beneficiaries need to have qualified for and missed an enrollment opportunity during this period. Eligible beneficiaries must submit their delayed enrollment request before June 17, 2020.

CMS has created a page for additional questions and answers.[3]

- COVID-19 Related Updates to Medicare Parts D and C Enrollment[4]

A Special Enrollment Period (SEP) is available nationwide to residents of all states, tribes, territories, and the District of Columbia effective March 1, 2020.

A beneficiary is affected and eligible for a SEP if he or she:

- Had another valid election period at the time of the incident period; and

- Did not make an election during that other valid election period.

The SEP is available for four full calendar months (through June 30, 2020). Further, an eligible beneficiary would be given one opportunity to make that missed election as a result of this SEP. Beneficiaries will not be expected to provide proof that they were affected by the pandemic-related emergency.

Beneficiaries can contact 1-800-MEDICARE (1-800-633-4227) anytime, 24 hours a day, 7 days a week with any questions. TTY users should call 1-877-486-2048. They can submit their enrollment request through 1-800-MEDICARE, their agent/broker, or by contacting the Medicare health or prescription drug plan directly.

Beneficiary-directed questions and answers for this SEP are available at any of the following links on CMS.gov and address issues such as eligibility for the SEP and how to enroll:

- Questions and Answers on the Medicare Managed Care Eligibility and Enrollment webpage: https://www.cms.gov/Medicare/Eligibility-and-Enrollment/MedicareMangCareEligEnrol/Downloads/Disaster_SEP_QAs_for_Beneficiaries.pdf

- Questions and Answers on the Medicare Prescription Drug Eligibility and Enrollment webpage: https://www.cms.gov/Medicare/Eligibility-and-Enrollment/MedicarePresDrugEligEnrol/index

__________________

[1] https://www.npr.org/2020/05/05/850106772/for-these-federal-employees-telework-means-productivity-is-up-

their-backlog-is-d

[2] https://www.cms.gov/Medicare/Eligibility-and-Enrollment/OrigMedicarePartABEligEnrol/index

[3] https://www.cms.gov/files/document/enrollment-issues-covid-ab-faqs.pdf

[4] https://www.cms.gov/files/document/special-enrollment-period-sep-individuals-affected-fema-declared-weather-related-or-other-major.pdf

– top

When the Centers for Medicare & Medicaid Services (CMS) suspended the regular survey system for nursing facilities during the COVID-19 crisis, it reported that, for a three-week prioritization period (beginning March 20) and since extended until further notice, it would suspend regular survey activities and conduct only two types of surveys: (1) complaints and facility-reported incidents that are triaged by the state survey agency as immediate jeopardy and (2) infection control surveys.

Historically, infection control deficiencies are cited at nearly two out of three nursing facilities in the country, making infection prevention and control the most frequently-cited problem in nursing homes nationwide. However, less than one percent of the deficiencies are classified as actual harm or immediate jeopardy; more than 99% are called “no harm.”

CMS sent advocates 169 infection control surveys that were conducted in 20 states between March 25 and April 21 and two additional infection control surveys that were conducted earlier in March. In reviewing those surveys, we found:

- 130 of the 171 infection control surveys (76%) did not identify an infection control problem at all.

- Of the 41 surveys that cited an infection control deficiency, 30 surveys (73%) described the deficiency as “no harm.”

- 8 surveys (.05%) initially cited the infection control deficiency as immediate jeopardy, but jeopardy was removed or reduced to a no-harm deficiency during the course of the survey (although one of the surveys, conducted in Washington State, was earlier than March 20).

- Only 3 of 171 surveys (.02%) cited immediate jeopardy (although one of the surveys, conducted in Washington State on March 16, was the Life Care Center of Kirkland, the first nursing facility in the country where coronavirus was identified).

Final regulations published October 2016, if effectively implemented and enforced, could reduce residents’ infections and hospitalizations, save residents’ lives, and save Medicare billions of dollars. Clearly, the infection control surveys show that we can and must do better at identifying infection prevention and control deficiencies and treating them seriously.

- Read the full report: https://medicareadvocacy.org/wp-content/uploads/2020/05/Special-Report-Infection-Control-5-7-2020.pdf

– top

Center Joins Coalition Urging Officials to Drop ACA-Repeal Lawsuit

The Center has joined a broad coalition of over 100 organizations in urging officials from 18 states and the U.S. Department of Justice to drop their Supreme Court lawsuit that seeks to strike down the entire Affordable Care Act (ACA). A letter sent by the Center for Health Law and Policy Innovation of Harvard Law School, the Center for Medicare Advocacy, and other health care advocates, providers, insurers, and worker organizations, focuses on the critical role the ACA will play in the nation’s response to the COVID-19 crisis.

While the lawsuit, California v. Texas, has been cruel and ill-advised from the start, the pandemic has only worsened its potential ramifications. The ACA is already covering over 20 million people through its marketplace plans and expansion of Medicaid. It will provide health coverage to many of the millions of Americans who are now losing their employer-sponsored insurance. The law requires health insurance plans to cover federally-approved vaccines free of charge and bolsters the nation’s infectious disease and public health functions through support of the CDC. The ACA also expands access to nursing facility information and helps ensure resident safety – particularly important provisions as tragedies have occurred in long-term care facilities around the country. Finally, as the Center has repeatedly pointed out, the ACA has strengthened the Medicare program and lowered out-of-pocket costs for beneficiaries.

All of this would be lost if the lawsuit succeeds. Unfortunately, Texas and the other plaintiff states, as well as the Trump administration, continue to support of a full strike-down of the ACA, even during the COVID-19 crisis. The Center urges that this misguided lawsuit be dropped.

– top

Reminder from CMS – May is Mental Health Awareness Month

May is Mental Health Awareness Month, and The Centers for Medicare & Medicaid services (CMS) wants to remind people with Medicare that the program covers mental health services to support them during these stressful times including:

- Telehealth counseling services during the COVID-19 public health emergency – learn more here: https://www.medicare.gov/coverage/telehealth

- Other outpatient mental health services, including depression screening, individual and group psychotherapy, and family counseling – learn more here: https://www.medicare.gov/coverage/mental-health-care-outpatient

- Counseling and therapy services from a Medicare-enrolled opioid treatment program (OTP) by telehealth options or telephone only, if you’re being treated for a substance use disorder – learn more here: https://www.medicare.gov/coverage/opioid-use-disorder-treatment-services

In these extraordinary times, it is important to remember that metal health support is available for people with Medicare.

– top –

Webinar: COVID-19 – Advocating for Nursing Home Residents

TOMORROW – May 8, 2020 – 02:00 PM

Presented by Consumer Voice, featuring Center for Medicare Advocacy Senior Policy Attorney Toby S. Edelman, this presentation will review the latest guidance, rules, and waivers issued by CMS and talk about what they mean for residents.

– top –

May 13, 2020 – 3:00 – 4:30 PM

Sponsored by the Christopher and Dana Reeve Foundation

A discussion the Medicare appeals process from Center for Medicare Advocacy experts who have handled thousands of appeals.

Presented by Center for Medicare Advocacy Senior Attorney Mary Ashkar and Attorney Paul Grabowski.

– top –